Related: What Type of Budget Should I Use? (With Descriptions) What is a forecast?Ī forecast is a technique for gathering historical data and using it to make informed and predictive estimates for the future. Variable costs, such as the cost of goods sold (COGS) and one-time purchasesįixed expenses, such as overhead and operating costs

Revenue from provided services, sales, and investments Here's a list of items to consider when you're making a budget: It can help you be prepared financially for unexpected events and costs. A budget can also help you plan your purchases, so you may be able to afford expensive items without requiring a loan. With short-term and long-term budgets, you can set financial and business goals, allocate resources, operate efficiently, increase savings, and measure business outcomes. You can calculate how much you earn, how much you spend, and what you spend on regularly. By creating a budget for a set duration, such as a week, a month, or a year, you can have more control over your finances.

#BUDGET FORECAST DEFINITION HOW TO#

Related: How to Create a Budgeting Template in 7 Simple Steps What is a budget?Ī budget is a detailed plan of the financial spending that a person, group, company, government, or any other entity expects to undertake in a specified period based on its revenue and expenses. The budget remains unchanged as the business executives provide details of the overdraft in the company's annual financial report.

#BUDGET FORECAST DEFINITION UPDATE#

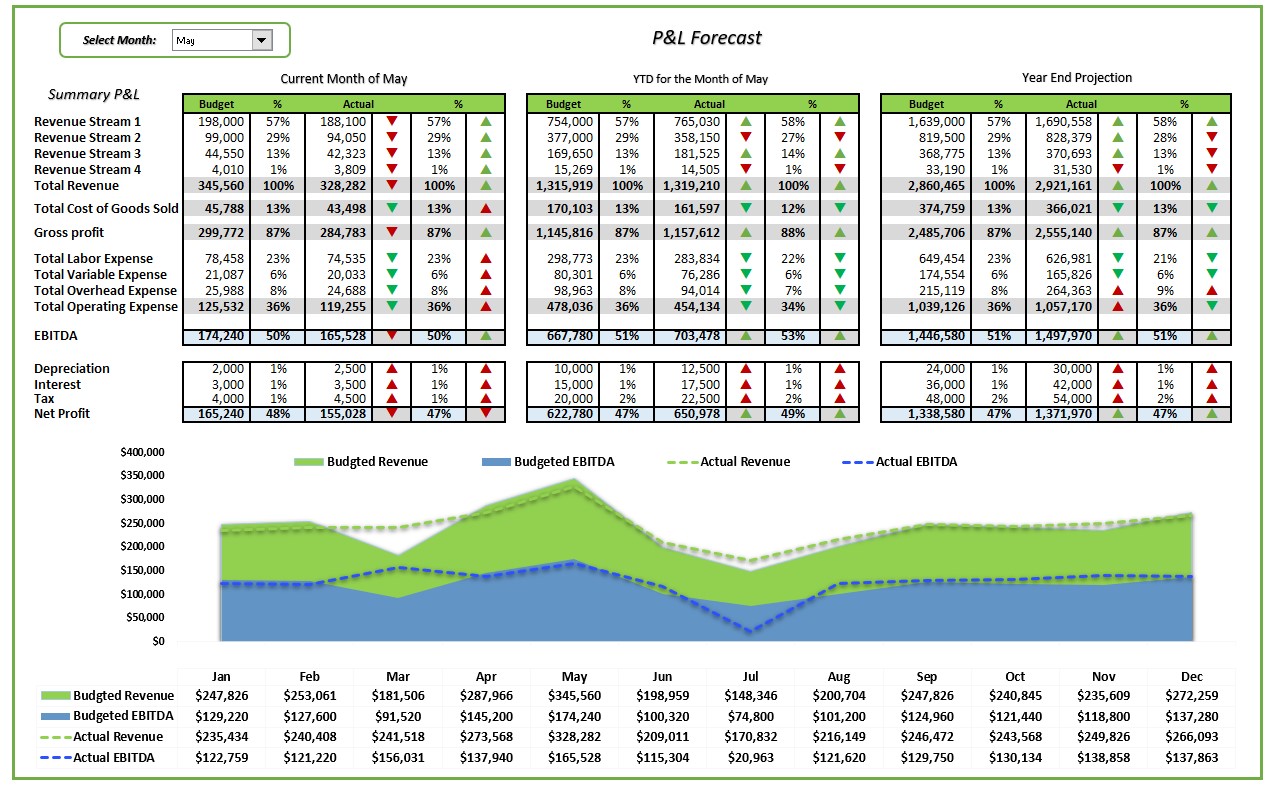

If the company exceeds its budgeted operational costs, business executives may adjust and update the forecast to show the correct result. Business executives may forecast fixed and operational costs and create a budget to stay within the projected costs. With a budget, you can plan the expenses you're likely to incur or are willing to sustain. With a forecast, you can get an idea of results based on available data. Comparatively, a budget is a static outline of your expected financial transactions and revenue. They can then make necessary changes so that their operations remain within their budget. Business executives can use the adjustable nature of forecasts to monitor the direction their company is taking. staticĪ forecast is liable to change throughout the specified period, and it's possible to assess the changes and make adjustments in business operations or budgets accordingly. Business executives use budgets to plan company finances and make informed decisions about their business operations. Budgeting involves creating a plan for future expenses and expected revenues. In a business setting, forecasting allows business executives to review current industry events and use the information to make effective and informed operational decisions. presentįorecasting involves using current data to anticipate a future situation in a specified period. budget, here's a list of ways that they differ: Future vs. If you're interested in learning the differences between forecast vs.

budget, explore what budgets and forecasts are, and review how to create a forecast budget. In this article, we discover the differences between forecast vs. By understanding the uses of forecasting and budgeting, and the difference between them, you can employ these tools to meet your revenue goals and reduce your expenses. You can use available data to make reasonably accurate forecasts of your financial situation and use budgeting to improve your financial management. Forecasts and budgets can help people and companies create detailed financial plans for personal and business purposes.

0 kommentar(er)

0 kommentar(er)